With ultimate respect to technical chart analysis…

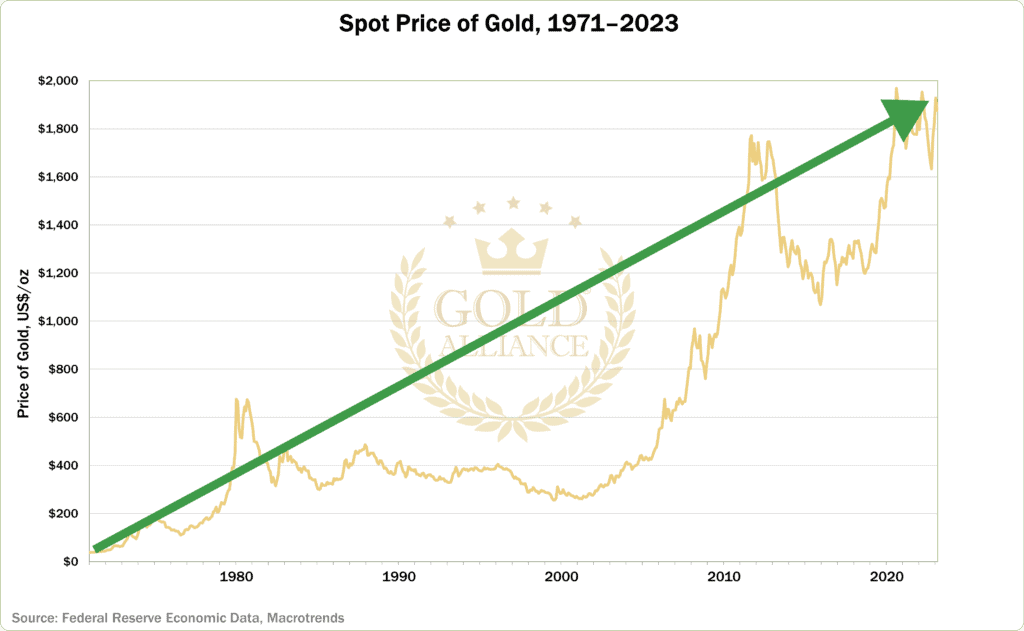

Watching any asset’s daily price fluctuations won’t give us a clear picture of where it may go. However, when you zoom out and look at the wider picture, you can get a better view of what the asset may do next.

Here’s what I mean and how this concept applies to the price of gold:

In the short term, any number of influences can push gold’s price up or down — fluctuations in the stock market prices, Powell’s remarks, hedge funds closing or opening positions.

Trying to decipher gold’s possible future by studying its short-term price action is like trying to view a painting with your nose an inch from the canvas. From that perspective, it’s almost impossible to understand the big picture. But when you step back, everything comes into focus, and the painting comes to life.

In the same way, when you look at gold’s wider historical performance, an exciting potential future comes into view.

We’ll come right back to that big picture in a moment to see why it may mean exceptionally good news for gold owners.

First, let’s put gold’s current price action into perspective…

As you may know, the Fed says it will continue to raise interest rates. And according to conventional wisdom, gold’s price could go lower if they do.

Why? Because higher interest rates make cash and bonds seem more attractive to investors than gold. So, when a mass of investor cash leaves gold, its price should go down.

Or so the theory goes.

Gold’s historical performance, however, seems to show otherwise:

If conventional wisdom held true, the price of gold should have fallen when the Fed raised Interest rates from 1.25% in 2004 to 5.25% in 2006. Instead, gold’s price rose from $392 an ounce to $675 an ounce.

And when the Fed raised rates from 0.25% in 2014 to 2.5 % in 2018, gold rose from $1,164 an ounce to about $1,300 an ounce.

The Fed raised interest rates again during its last meeting. And a few days back the price of gold dropped a few dollars before heading back up again. So, for a moment, it may have seemed like conventional wisdom was right.

But when you zoom out to a wider view, the truth appears:

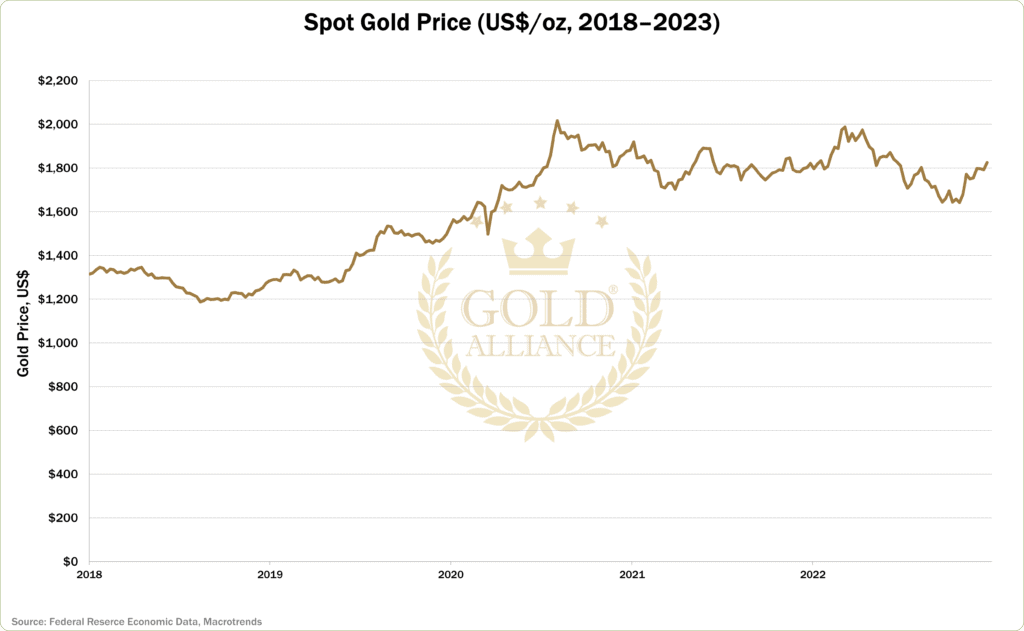

Over the last five years, while interest rates have been raised from 0.25% to 4.75%, the price of gold has risen about 40%.

And folks who owned, say, $20,000 in gold during that time would have seen it turn into $28,000 in gold.

Now, let’s ignore interest rate hike periods and look at times of financial crashes:

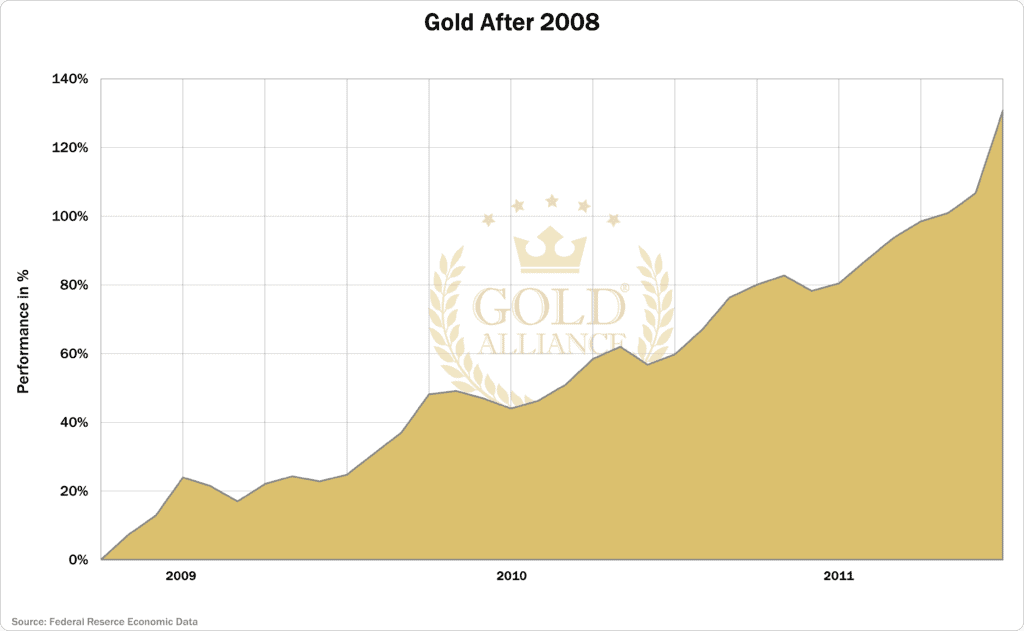

As we zoom out to the 2008 financial crisis, we see the price of gold averaged around $800 per ounce before the crisis. After the crash, America slipped into the most intense economic downturn since the Great Depression. And after a brief drop, gold recovered and skyrocketed to a new price record of $1,896 by 2011.

That’s a gain of over 137% in less than four years.

And folks who owned $20,000 in gold during that time would have seen it turn into about $47,000 in gold.

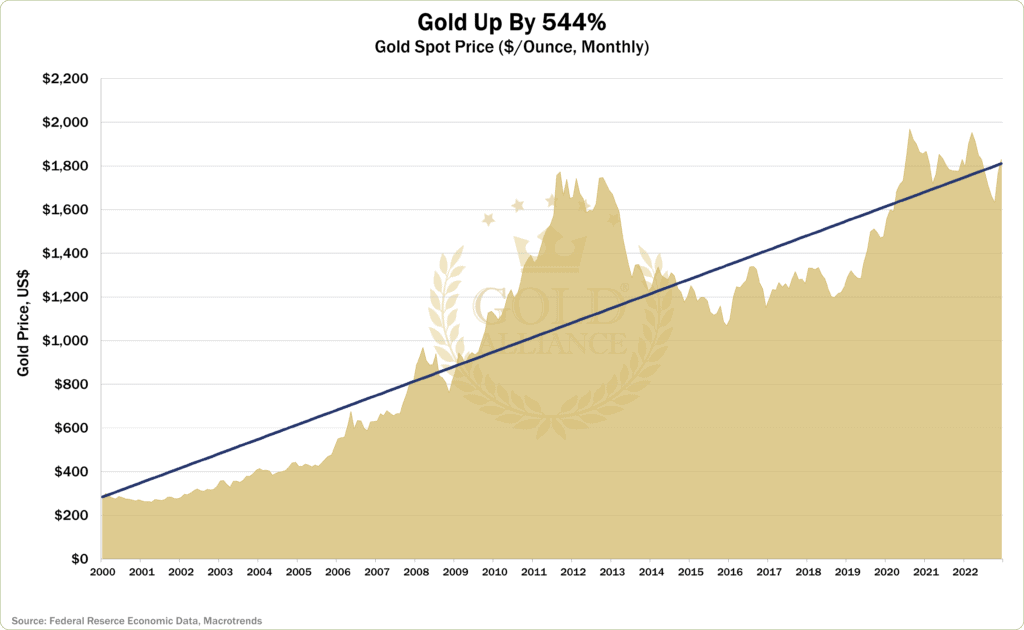

Now, let’s ignore financial crashes and zoom out to view the last two decades… and we see gold has risen over 540% since 2000.

And folks who acquired $20,000 in gold then have seen it turn into about $128,000 in gold today.

Now, zoom out all the way to Gold’s Big Picture, and we see something stunning…

Through all America’s bouts of sky-high inflation, punishing recessions, devastating market crashes, exhilarating stock market bull runs, pandemics, money printing, deficit spending and more…

And despite corrections in gold’s price as with any asset class…

Since 1971 when we were removed from using gold as money via the Gold Standard, gold’s price has only moved in one overarching direction:

UP 4,850%

So then, when will gold skyrocket next?

Well, nobody can ever be 100% certain. But what I can say for sure is this:

While past performance is no guarantee for future results, I’ve yet to hear a convincing reason to believe gold will suddenly stop behaving as it always has.

Nor have I heard any reason to believe the US dollar will suddenly regain all its lost purchasing power… or the Fed will wave a magic interest rate wand and fix inflation overnight… or the frightening global economic turmoil we’re all seeing will simply resolve itself.

Bottom line:

We’re facing an incredible amount of economic turmoil with no clear end in sight. And folks who worry over gold’s daily price fluctuations may want to step back and take a good, long look at gold’s historical price performance.

Because the big picture may be telling us we have a brief window of opportunity to own gold at a relative discount now… before the price of gold rises to a new high as it has so many times before.

————————–

If you’d like to speak with a Gold Specialist about fortifying your current gold holdings or getting started now, dial toll-free 888-371-5576. If you’re new to gold and need more information, you can get a FREE copy of our Gold Information Kit now, right over here.