Analysts say concerns are rising over a possible economic situation the nation hasn’t seen since the 1970s:

Stagflation — a rare combination of high inflation and a recession.

We already have inflation. Now, many experts believe a recession is possible, so the rising possibility of stagflation has investors and analysts paying close attention.

Fortune says institutional investors think stagflation is a bigger challenge “to the U.S. economy than a recession.”

Time.com says the economy “may be entering a new era of Great Stagflationary Instability.”

And Morgan Stanley advisors agree and say we may be entering “A period of ’stagflation’ — slow growth, persistent inflation and a rise in unemployment — may be in the offing.”

If they’re correct, this puts the Fed “between a rock and a hard place.”

As Nouriel Roubini, the top economist who predicted the 2008 global crisis, says the Fed and global central banks face a “lose-lose” situation.

If they try to fix one part of this economic conundrum — say, raising rates to tamper down inflation — their actions could affect other parts of America’s economic challenges, like possibly slowing economic growth or potentially spurring more unemployment.

Some folks are quick to point out how inflation has dropped, which means we might avoid stagflation.

And yes, that’s true, inflation is lower.

Yet, nobody knows if it will continue to drop or remain persistently high.

So, what can the government do?

Mark Zandi, chief economist at Moody’s Analytics, believes it will be very difficult to navigate as the debt-ceiling debate continues to remain a challenge for the federal government.

In his recent analysis, Zandi says, “Just how lawmakers will resolve the impasse over the debt limit is thus uncomfortably uncertain. There are many possible scenarios, each with different macroeconomic implications.”. And he believes even a short-lived failure to pay government debts could trigger many corporate bankruptcies.

And he may be right:

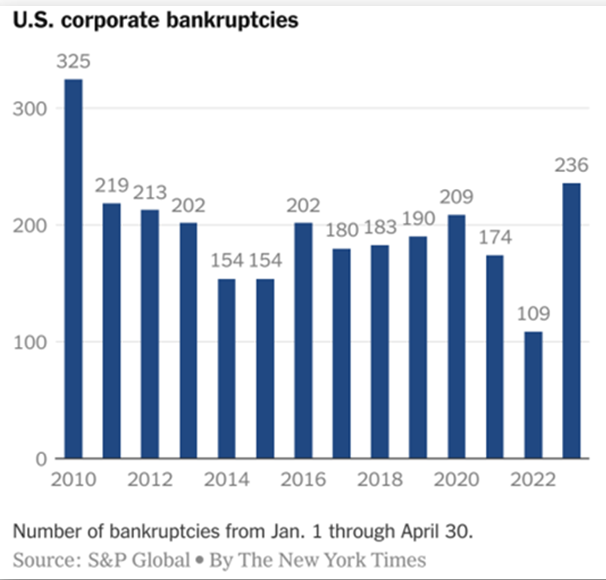

As you can see in the chart above, at least 236 large corporations have filed for Chapter 11 bankruptcy so far this year. And U.S. District Courts also recorded about 16,200 bankruptcy filings among all types of companies in the same period.

These are significant numbers the Fed is watching closely…

Because the number of bankruptcies this year is more than double last year’s levels according to a recent S&P Global Intelligence report.

Additionally, challenges in the banking industry in March may have contributed to a rise in bankruptcy filings in that sector this year. And the highest-profile filing was the parent company of Silicon Valley Bank.

I’d say this may be part of why the 2023 Outlook Survey of institutional fund managers by mega money management firm Natixis revealed 73% of institutional fund managers think it will be impossible for the Fed to engineer a soft landing.

And 65% believe the bigger risk in 2023 is stagflation.

At this point, nobody is certain how the Fed will face the economic challenges before them or whether stagflation is a possibility.

But the question is: How did the economy slip this far?

Who is to blame?

The Editorial Board of The Wall Street Journal points to challenges with the current administration’s policies, saying they may have:

“…produced slow economic growth, falling real wages and soaring prices.” And the administration “inherited a growing economy primed to roar back from the pandemic” and has “dragged America back to the 1970s. … This is what the policy mix of trillions in federal spending, heavy regulation, the threat of higher taxes, and easy money has wrought. Time to do the opposite.”

Okay, well…

Where has waiting for the Fed to “do the opposite” gotten us so far?

From where I’m sitting, enough is enough. Time for us to do the opposite.

Which is why I believe it is so important to own gold.

Because gold has historically performed very well during periods of stagflation.

So, keep your eyes on gold’s price if you are a gold owner.

And if you do not own gold yet, it may be time to speak to a Gold Alliance Gold Specialist about your options.

————————–

To speak with a Gold Alliance Gold Specialist now, call toll-free 888-529-0399. There’s no cost or obligation. Or, if you’d like to learn more about how owning gold can help you secure your long-term financial future in uncertain economic times, click here to claim your FREE Gold Information Kit now.