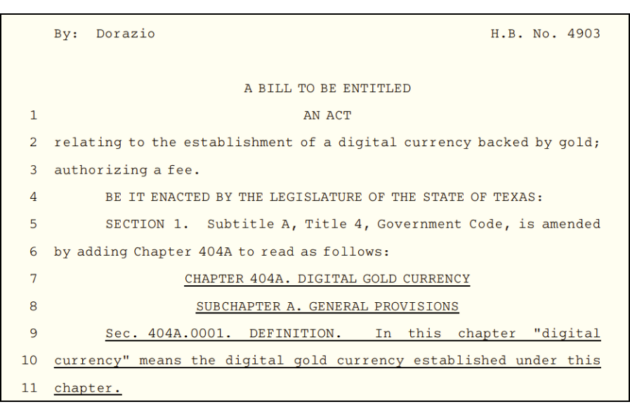

On March 10, 2023, Texas Representative Mark Dorazio (R) filed revolutionary House Bill 4903 to create a digital currency fully backed by physical gold held in the Texas Bullion Depository.

If the bill passes, Texas will become the first state to issue an alternative to the US dollar. And its citizens would use a bullion-funded debit card to pay for goods and services, withdraw physical gold or cash and send money to another person.

In effect, this would let Texans opt out of using the dollar — a currency “printed out of thin air” — in favor of sound money… for the first time since Nixon decoupled the dollar from gold in 1971.

And when you consider this against the backdrop of a nation caught neck-deep in financial quicksand…

I’d say “digital gold” is a game-changing idea whose time has come.

Because people everywhere feel uneasy about America’s financial future…

Investors are spooked…

And now, with the recent bank failures, high inflation, a possible recession, the dollar losing its purchasing power, global de-dollarization efforts by BRICS and the Fed’s proposed CBDC (Central Bank Digital Currency) in the works…

Support for Rep. Dorazio’s “digital gold” bill is growing fast:

On April 26, 2023, hundreds of Texans from every corner of the vast state sent a 78-page document to the Texas House in support of the bill.

S. Rothschild expressed concerns about the safety of the Fed’s proposed unbacked “digital dollar,” saying, “a gold-backed digital currency would combine the safety of owning gold with the transactional ease of digital currency, creating an option for people to transact business in sound money, set the stage to create a viable alternative to a central bank digital currency.”

R. Roland is fed up with the Fed’s money printing and wrote: “…the US dollar can no longer be trusted. If the Fed can print 1, 2, 3 trillion dollars, why not 10 trillion, 100 trillion, a quadrillion? And they can give the money to whomever they choose — while putting all the rest of us in the poorhouse.”

Supporter T. Mcqueen agrees the dollar is in trouble and implored the legislators: “We are dealing with a failing US Dollar [and it isn’t a] matter of if but when it collapses. It makes sense that we have a [gold-backed digital currency]. So we can help secure our economic independence from a failing federal government. We need this more than ever to protect our 9th largest economy in the world.”

The list of urgent support comments goes on and on.

And Texas isn’t the only state focused on securing “economic independence” …

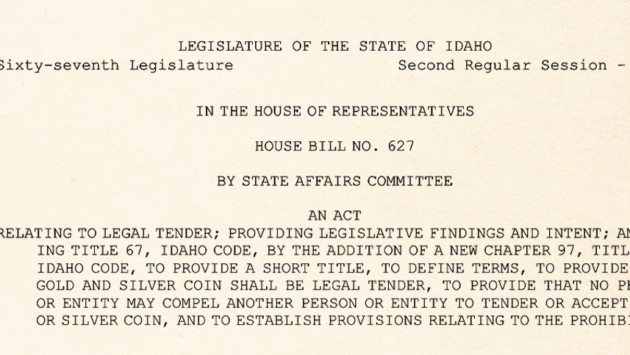

So far, three states have already declared gold and silver legal tender:

Utah was the first in 2011. Oklahoma made gold and silver legal tender and exempt from state tax in 2014. And Wyoming defined gold as legal tender in 2018.

Additionally, 23 other states have also moved to reintroduce gold and silver as legal tender — including Texas.

If the idea spreads…

If the bill passes…

And if enough states follow Texas, some analysts say it could threaten the Fed’s currency monopoly.

In a paper for the Mises Institute entitled “Ending the Federal Reserve from the Bottom Up,” constitutional tender expert Professor William Green says, “Since its inception, the U.S. Federal Reserve’s monetary policies have led to a decline of over 95% in the purchasing power of the US dollar.[… A] new tactic is needed, which could achieve the desired goal of abolishing the Federal Reserve system” by “pulling the rug out from under it […] to make its functions irrelevant at the state and local level.”

And he adds:

“As this happens, a cascade of events can begin to occur, including the flow of real wealth toward the state’s treasury, an influx of banking business from outside of the state — as people in other states carry out their desire to bank with sound money — and an eventual outcry against the use of Federal Reserve notes for any transactions.”

In other words, if the bill passes, the ability to use gold instead of Federal Reserve notes could trigger other states to consider a return to sound money.

And if enough states follow suit, it could end the people’s dependence on fiat currency and help usher in a new era of sovereign financial freedom and economic prosperity.

All gold owners in favor, say “Aye!”

————————–

If you want to learn more about how to help secure your financial future with physical gold, click here to get a FREE Gold Information Kit personalized to match your unique needs and goals. Or dial toll-free 888-529-0399 now to speak with a friendly Gold Specialist and get patient, clear and transparent answers to all your questions. There’s no cost or obligation.