Last Friday, $200 billion Silicon Valley Bank collapsed and became the second-biggest bank failure in US history.

News of the bank’s insolvency spread like wildfire. And many smaller banks felt the pressure as worried customers pulled their deposits and moved their money to larger banks. The contagion has seemed to pause as the federal government stepped in to pay for the bank losses.

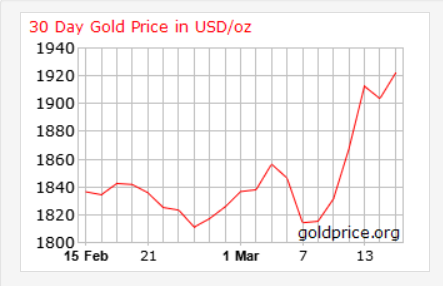

Meanwhile, gold saw a dramatic rally in price as spooked investors moved into historical safe-haven assets.

What does this mean for gold’s future?

Who is to blame for this banking crisis?

And how did the 16th largest bank in the US lose billions of depositors’ dollars in a single day?

The problem started in 2021, when deposits flooded SVB…

Rock bottom interest rates and excessive money printing were a boon to the tech industry. And recent analysis revealed more than 1,000 tech firms had deposits in SVB.

With the flood of large deposits, the bank had more money in its coffers than it could lend. So, that extra money was available for the bankers to invest and profit. And the bank decided to invest the money in 10-year Treasury bonds and other long-term securities.

Why Treasury bonds? Because US bonds are backed by the full faith of the US government. And for a long time, many investors considered them the safest of all assets as they are generally more stable than stocks.

But as safe as they usually are, Treasury bonds can lose value when interest rates rise.

Which is exactly what happened to SVB.

When the Fed started hiking interest rates, the value of SVB’s portfolio of US Treasuries tumbled. The bank realized it was losing money. So, it started selling its poorly performing Treasuries and stocks to (hopefully) cover the losses.

But then, on March 8, SVB announced they were selling their entire bond portfolio. The swift fire sale ended with SVB suffering a $1.8 billion loss.

When the news broke, the bank’s stock dropped 69% in a day. Many big fund managers recommended that their startup clients pull deposits from the bank. And by March 9 panicked depositors had pulled $42 billion out of the bank.

This massive and swift bank run caused SVB to collapse.

And then… the federal government came to the rescue.

On Friday evening, the Treasury called an emergency Zoom meeting for Congress. During the meeting, Congress learned of the government’s plans to cover the depositors’ losses. And on Monday, March 13, the President promised the FDIC would pay the depositors all their money.

Now, here’s the interesting part:

Under normal circumstances, FDIC insurance only covers deposits up to $250,000. This goes for all US banks. But SVB was no ordinary bank because most of its depositors were startup companies with deposits over $250,000.

So, to “solve” this problem, the Fed established a new Bank Term Funding Program. And this new program lifts the former $250,000 FDIC insurance cap for all banks and lets the banks borrow billions to pay the depositors.

Although the government promised to cover SVB depositors’ losses, they also made it quite clear:

They are not protecting the bank or the bank’s management.

Nor are they covering the losses for the bank’s stockholders or uninsured bond holders.

The funds are strictly used to recover missing deposits.

The problem is… any institution holding US Treasury bonds is also sitting on unrealized losses. And the FDIC estimates total unrealized US banking losses may total a staggering $620 billion.

However, the FDIC only has about $128 billion on hand to cover the losses. And if my math is correct, they may soon be more than $500 billion short. So, who will cover that gap? The President said taxpayers won’t. But where will the money come from?

Even worse, the FDIC may also be suffering unrealized losses.

Why? Because the $128 billion in the FDIC’s available funds is invested in — you guessed it — US government bonds!

Even crazier…

SVB’s Chief Administrative Officer was the CFO of Lehman Brothers at the time of its crash in 2008. In 2015, the CEO of SVB, Greg Becker, successfully lobbied the government to relax some Dodd-Frank provisions on regional lenders. And until the SVB collapse Becker was on also the board of the Federal Reserve Bank of San Fransisco… the central bank in charge of supervising SVB.

Now SVB shareholders are suing the bank’s parent company, CFO and CEO for fraud.

Plus, this is all happening as the Fed was planning to keep raising rates

But let’s not forget, rate hikes lowered bond prices, which helped trigger SVB’s losses in the first place.

Round and round it goes.

So where do we go from here?

Right now, the losses in US Treasury bonds are spreading to foreign bondholders — further compounding the systemic risk on a global level.

And with high inflation, international turmoil and a possible recession compounding the situation, the markets are beyond uncertain.

But here’s the possible good news for gold owners:

After the fiasco on Friday, March 10, investors pulled cash from their banks and flooded the so-called “rescue asset” markets. Gold is one of those assets. And the flood of capital into gold helped push its price up fast.

Since March 9, a day before the SVB fiasco, gold has risen 4.5%. And this sharp rally put the price of gold within reach of its 2022 record high of $2,074.88.

There’s more good news on the gold side.

For several reasons, the pressure has been building in the gold market for many months:

Central banks have been buying record amounts at a faster rate than they have in years. Inflation’s “hidden tax” has been eating away at the dollar’s purchasing power — pushing folks to seek a better store of value. And every day, we hear from people who are considering gold because they’re concerned about securing their long-term financial futures.

And they do it because of a well-known fact:

Gold has rallied after nearly every economic downturn in US history. Including the 2020 crash and the eerily similar 2008 financial crisis.

————————–

If you haven’t yet diversified your savings with physical gold, consider these two options

1. Get a FREE copy of our 2023 Gold Information Kit personalized to match your situation, goals and needs.

2. Speak with one of our Gold Specialists about the benefits of shifting a part of your 401(k) or savings into a Gold IRA. Dial toll-free 888-529-0399 now for a FREE consultation where you’ll get clear, useful answers to all your questions. And when you decide you’re ready to make your move, we’ll make everything simple, safe and easy for you. There’s no cost or obligation.