What Is the Gold Standard?

While gold is a highly sought-after commodity, you might be thinking that it’s only so popular because it’s so difficult to mine. However, that isn’t the case. Gold has intrinsic value that gives it significant value in industries like technology, which makes it even more highly sought-after.

Now, it used to be that countries would back their currency with gold to give their money more credibility and maintain its purchasing power. This was known as the gold standard.

How does a gold standard work?

When a country uses the gold standard, they back their currency with gold. There is a direct correlation between how much physical gold the country holds and the amount of currency they produce.

Any country using the gold standard sets its own fixed price for gold. This is the price they buy and sell gold at. Let’s say a country decides the gold price is $100 per ounce. That means the value of $1 is 1/100 of an ounce. The value of the currency is directly linked to gold.

Ultimately, the gold standard is a way to support the currency of a country. Every increment of currency or money that country has is supported by the amount of gold the country owns. While most countries still have large stores of gold, no country still uses the gold standard.

What makes gold the standard?

The intrinsic value of gold has made it a medium of exchange for centuries. And most of those who support the gold standard choose gold for this reason. It’s the value of gold outside of the monetary system that really catches people’s eyes.

Gold can be used for dentistry, decoration, electronics, and jewelry, which means gold will always have value. Additionally, gold is a finite resource, and it is impossible to counterfeit — gold bullion or any other gold product cannot be produced or replicated in a lab.

The finite quantity of gold can limit inflation for countries who adopted the gold standard.

Where does the gold standard come from?

Before gold was minted into coins, back in 650 B.C. it was used in trade with weights and a purity review process. However, once civilization began creating coins, gold was boosted as a monetary unit.

In 1696, England introduced new technology that delivered automated production of coins, which secured their value. This was known as the Great Recoinage, and it gave England an edge on coin value because minting these coins meant it was more difficult to counterfeit the gold and easier to set the purity.

In 1789, the US Constitution gave Congress the power to regulate coins. The national currency that was created brought standardization to American money, which had not existed before this point.

Three years later, we adopted the bimetallic standard that backed our currency with gold and silver because silver was easier to access and existed in greater quantities than gold.

After World War II, a system similar to a gold standard, sometimes described as a “gold exchange standard,” was established by the Bretton Woods Agreements.Many countries fixed their exchange rates relative to the dollar, and central banks could exchange dollar holdings into gold at the official exchange rate of $35 per ounce. Thus, all currencies tied to the dollar had a fixed value in terms of gold. The Bretton Woods agreement favored the US dollar and pretty much forced Allied countries to use the US dollar rather than gold.

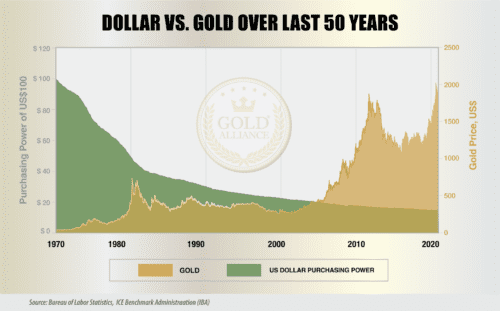

Then, in 1971, Nixon took the US off the “gold exchange standard” — he took the gold away, leaving just the (unbacked) US dollar as the world’s reserve currency. Since then, the purchasing power of the US dollar has been on a steady decline ever since.

Why is a gold standard so important?

When countries don’t back their currency with physical commodities, it’s called a fiat system. Fiat systems create monetary markets that consistently fluctuate and can lose stability easily. The only thing that gives fiat money value is the government who printed it, and the faith we have in the dollar (“fiat” is Latin for “faith).

The United States government adopted this arbitrary currency in the 1970s, and we felt inflation hit almost immediately. Without anything to back it up, the US dollar has lost more and more purchasing power.

Luckily, you can still buy your own physical gold and hold onto it, just in case the US dollar completely loses its value.