Is a Precious Metals IRA Right for Me?

There are advantages of owning physical gold and other precious metals, but you might be wondering whether a Gold IRA is right for you. Here’s how a Gold IRA may address the typical concerns we hear from people inquiring about diversifying with precious metals.

Most Americans’ IRA and 401(k) portfolios consist mainly of stocks and bonds. If you’re one of them, you’re probably concerned about how the next market correction could impact your savings. IRAs and 401(k)s experienced a 50% decline in 2008 that took about 4 to 5 years to overcome. With inflation on our hands, time works against us, and many people are close to retirement age and may not have the time to recoup the losses to their nest egg.

Adding physical gold to your savings in a Gold IRA may help protect them because gold historically has a great tendency to move opposite of dollar-denominated assets. During times when we faced economic difficulties and traditional assets such as stocks crashed, gold achieved a return that helped to stabilize portfolios.

“I’m worried about how inflation impacts my savings”

Most Americans are placing their savings in dollars and dollar-denominated assets, such as stocks and bonds. With inflation eating away at the value of the dollar, you have every right to be concerned about how it impacts the purchasing power of your savings. Will your savings be enough to cover the rising prices on everything from groceries and gas to housing and healthcare during your golden years?

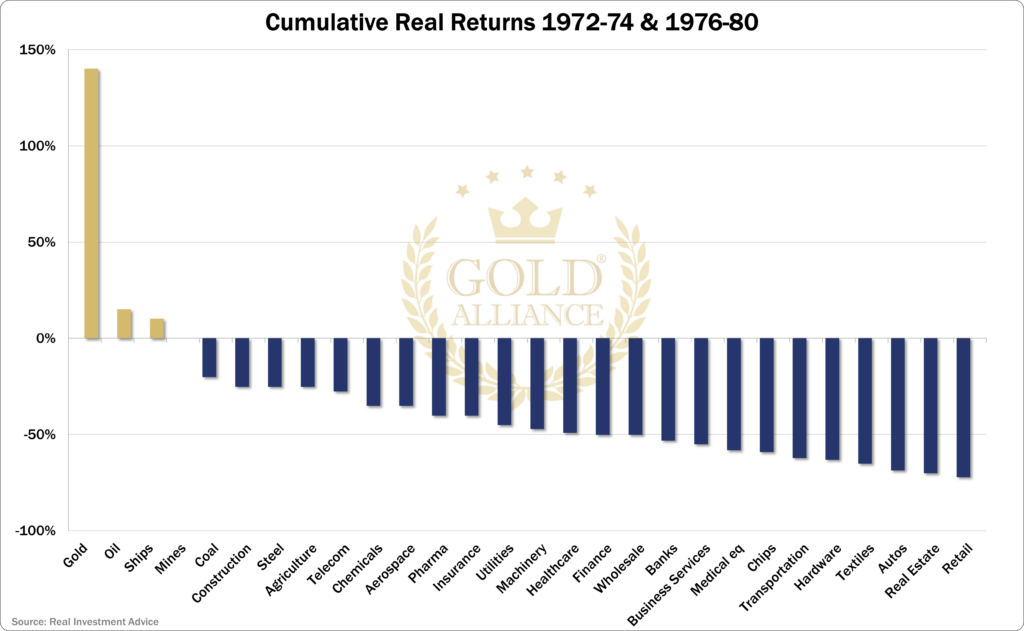

By rolling over a portion of your IRA/401(k) into gold, you may hedge against inflation. Historically, gold and the dollar are uncorrelated. This means that gold may increase in price over time when inflation rises, which can counteract the negative effects inflation has on cash. In the inflationary periods of the 1970s, gold was the best-performing asset, which has helped many Americans even grow their wealth when other assets tumbled.

And if inflation keeps rising like it did in the 1970s, when people were running away from crashing stocks and bonds to the safety of gold, we may see gold outperform every single asset throughout the decade like it did back then.

“I own real estate and I’m concerned about another 2008-style crash”

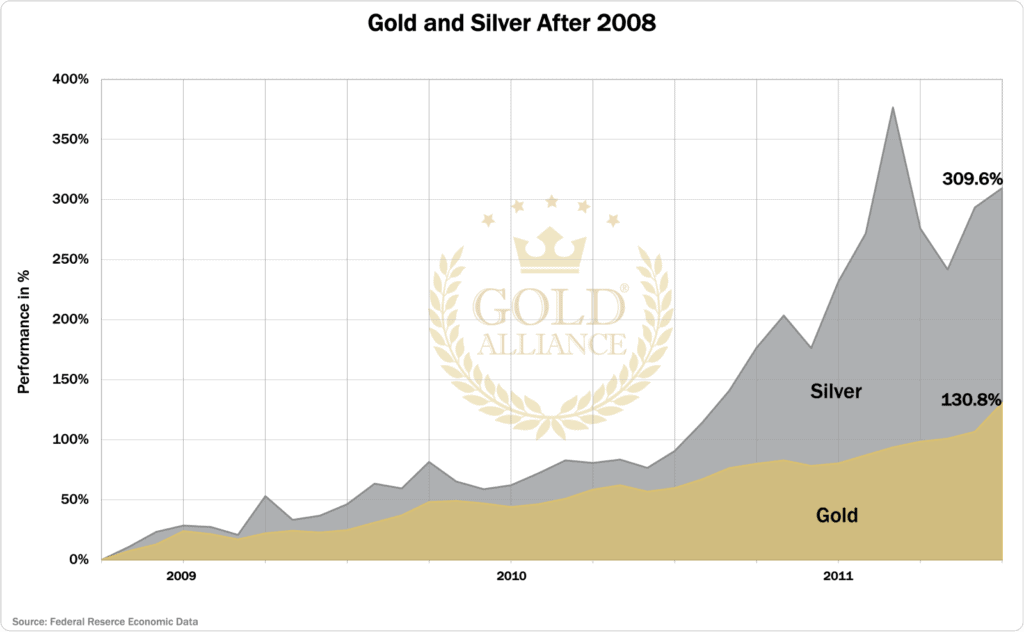

If you’re concerned about how another Great Recession could impact the stock market and the real estate markets, just look to the performance of precious metals after the housing market crashed in 2008. The price of gold went up 130.8% in the aftermath of the crisis, while silver climbed a stunning 309.6%. This remarkable growth helped many Americans who had allocated a sufficient amount of their IRA/401(k) to physical metals avoid the devastating effects of the crisis.

“Is a Gold IRA is right for me?”

Whether or not you share these concerns, a Gold IRA may still be a great choice since it can offer not only diversification but also growth.