In early 2020, the Fed’s benchmark interest rates hovered near zero, and inflation was 1.06 percent.

By March 16, 2022, the highest inflation in 40 years had gripped the nation, and the Fed started raising rates to tamp it down.

Now, after 11 rate hikes in 18 months, the Fed hit the pause button at the FOMC (Federal Open Market Committee) meeting last Wednesday.

According to the Fed’s post-meeting press release, “the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.”

CBS News says the pause is “giving borrowers a breather.”

And it’s true: borrowers won’t face new rate hikes… for the moment.

But it’s still the highest benchmark rate range America has seen in over two decades.

The economy is still reeling from high inflation. Americans are still dealing with elevated prices and borrowing costs. And remarks by the Fed seem to indicate rate cuts aren’t in the cards just yet.

So, what’s the Fed’s next move?

Fed Chairman Jerome Powell says the committee will “assess additional information and its implications for monetary policy.”

In other words, the FOMC is stuck playing the waiting game, and America is too because…

The Fed is caught in a catch-22

As we discussed last week, the central bank must decide whether to raise interest rates high enough to push inflation back down to 2% a year and risk triggering a recession…

Or lower rates so more Americans can afford loans and pay down credit card debts.

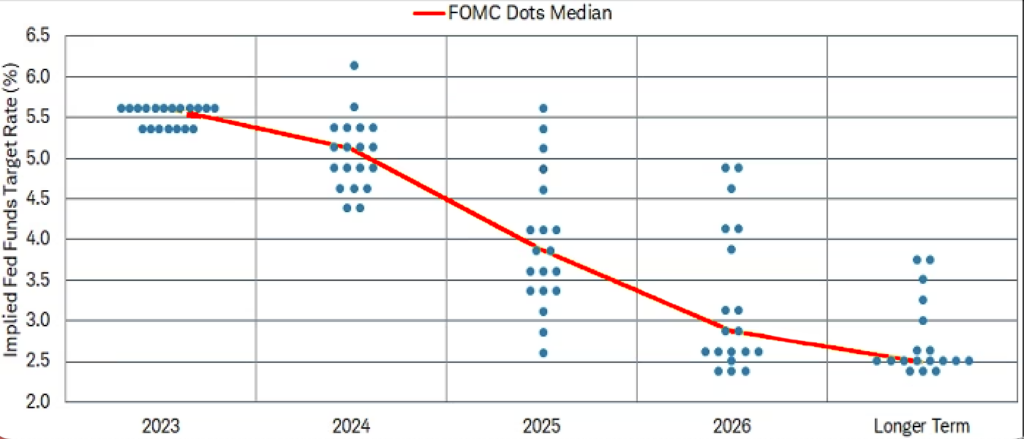

Meanwhile, despite the Fed’s uncertainty, the FOMC’s “dot plot” data show interest rates may remain elevated until 2026.

This may mean the Fed believes inflation isn’t falling fast enough and they may have to start raising the benchmark rate again. Fed Chief Jerome Powell says, “raising it once more this year is more likely than not.”

That said, after that likely rate hike, the FOMC says it expects to make two 25-basis-point cuts… at some point. When the cuts will happen is unclear, but Powell declared they “will come at some point, and I’m not saying when.”

According to a Charles Schwab analysis, this “may mean more volatility ahead” for the economy.

And the Fed’s decision to “wait and see” may also mean they believe inflation could remain high for some time… which could affect struggling Americans in several ways.

For starters, Lending Tree says the average credit card interest rate is now an astonishing 24.45%, and “rates are climbing, thanks to recent rate increases from the Federal Reserve, and are likely to continue.”

This is the highest rate many Americans have ever seen. And for those who’ve been relying on credit cards to keep their heads above water, a rate cut can’t come soon enough.

But that’s not the only rate concern:

The average interest rate on a new car loan is almost 13% for folks with higher credit scores. And for folks with lower credit scores, the rate has risen to almost 24%, according to US News.

High interest rates also make it hard for buyers to afford a mortgage.

The New York Times reported, “The average 30-year fixed-rate mortgage has climbed above 7 percent.” And according to mortgage tech and data company Black Knight, the cost of paying principal and interest on mortgages has skyrocketed 60% — the highest on record.

On top of it all, food prices are still high… gas prices are high… prices for just about everything remain high.

The good news for gold owners is…

Historically, gold outperforms inflation.

In fact, a World Gold Council study found gold has outperformed inflation since 1971, returning an average of 8% per year when inflation is 2–5% and returning 15% per annum on average when inflation has been higher than 5%.

This happens in part because inflation devalues the dollar. And, as you know, the price of gold historically rises as the value of the dollar falls.

Now, with inflation rising and the value of the dollar falling…

Plus, global de-dollarization efforts, increased central bank gold demand, a $33 trillion federal debt, the Fed’s next rate hikes, continued money printing and more…

Gold may be poised to soar.

Or call 888-529-0399 to schedule a free consultation with an experienced Gold Specialist. There’s no obligation.