Last updated: 2/4/2024

Gold has been a highly valued asset ever since it was first discovered and used as currency thousands of years ago, but when was the gold price highest ever? And what about its highest value ever in terms of purchasing power? In this article we’ll explore the highest points through history for gold from the perspective of price, purchasing power, and value-adjusted inflation.

> Click to Get Your FREE Gold & Silver Information Kit. Discover simple steps you can take today to help secure savings and your long-term financial future with confidence. No cost, no obligation.

Or dial toll-free 888-322-2942 to speak with a Gold Specialist about your needs and goals now.

What was the highest gold price ever and throughout history?

If you want to know the all-time high gold price, you’re in the right place. Not only will we cover the question “What is the highest price of gold in history?” but we’ll also cover essential and notable time periods for gold. But let’s answer the most burning question first:

What is the highest price gold has been?

ING analysts forecast record highs with a fourth-quarter 2024 average of $2,100. And InvestorPlace says, “Gold has upside potential to $2,300/ounce in 2024.”

On the high side, currency expert and former advisor to the White House Jim Rickards says, “Gold could reach $5,000 per ounce…”

Why did December 2024 have the top gold price?

What was the highest ever gold price in ancient history?

Roughly 50 years later, around 250 AD, gold was debased even further to around 70 coins per pound. This accelerating debasement meant the value of the currency dropped so much that Rome’s economy entered a state of extreme hyperinflation. Prices soared over 1,000% across the ancient empire, and the Roman government attempted to sustain the empire with massive taxes to compensate. Many historians believe this economic collapse was actually one of the most significant factors leading to the fall of Rome.

What factors set up the gold price to reach its high points through modern history?

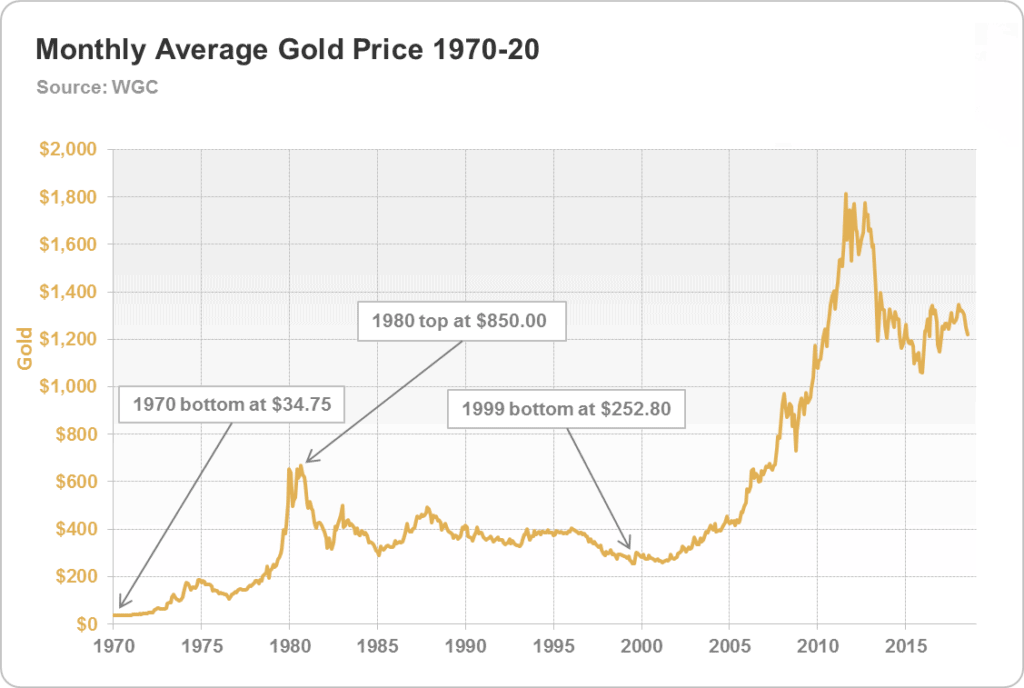

The gold price set a new high in August 2011 at $1,825 as investors looked for a way to hedge against the market turmoil following the Great Financial Crisis of 2008, which swept across the globe. The burst of the housing bubble drove the world into a deep crisis that would linger for years, and when the US entered a debt-ceiling crisis and both Moody’s and S&P downgraded the outlook on US finances, investors flocked to gold.

In early August 2011, S&P issued the first-ever downgrade of the federal government’s credit rating, and as a result stock prices plummeted, and gold reached its top gold price at that time.

Whether you look at the nominal gold price or its price adjusted for inflation, there is one clear conclusion you can make: The price of gold has been on an upward trajectory, especially since Nixon took the US off the Gold Standard. You can also read about why experts think gold may soar to record highs.

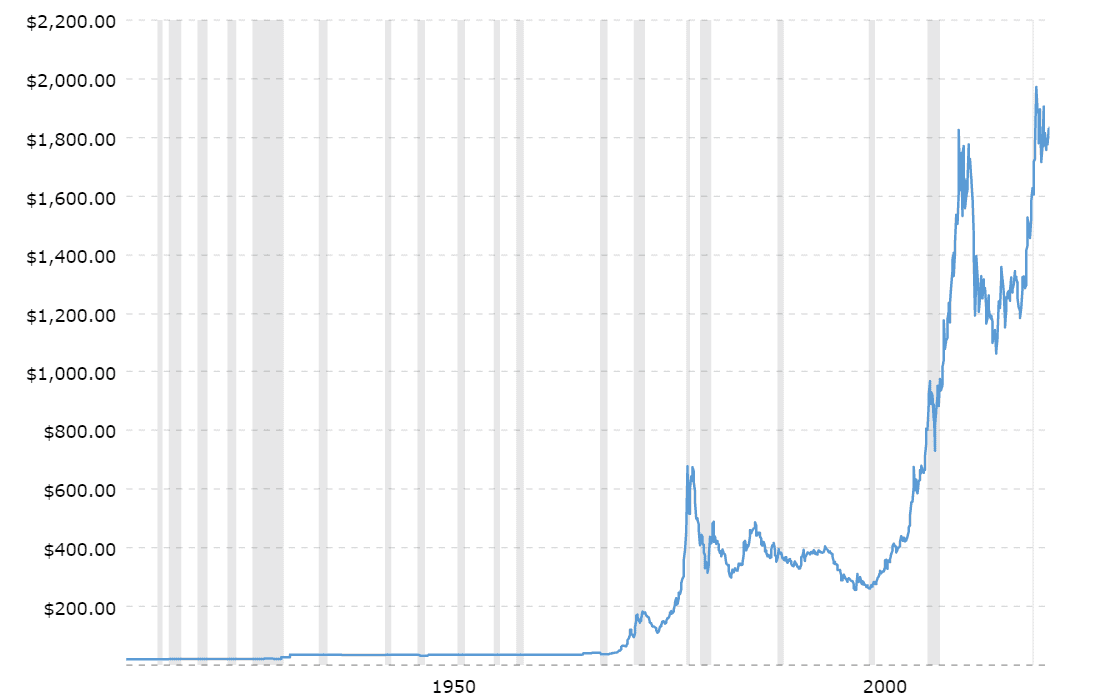

The chart below shows the nominal price of gold over the last 100 years.

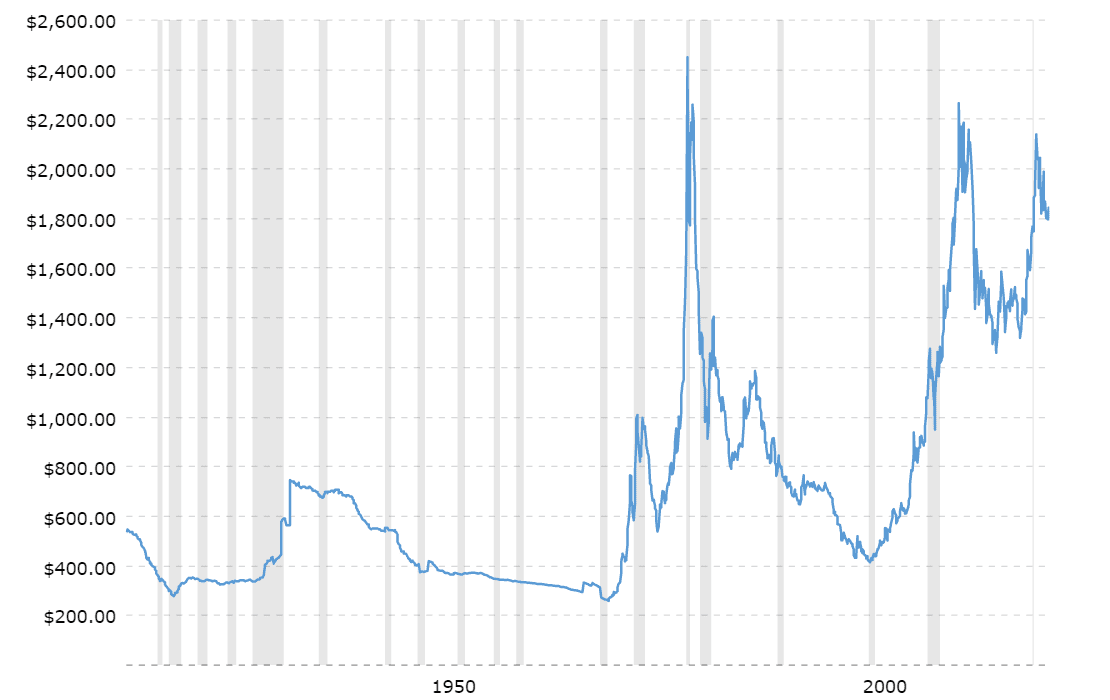

And this chart shows the value of gold when adjusted for inflation.

What caused gold prices to spike in the 1970s?

Gold’s value skyrocketed in the 1970s after the United States ditched the Gold Standard and switched to “fiat” money — currency that is no longer backed by gold.

In 1970, the price of gold was $38.90 an ounce, but as soon as we left the Gold Standard, people turned to gold in anticipation of the possibility of an inflation crisis, and that proved to be a wise decision. By the end of 1974, the price of gold hit $183.77 an ounce, showing over 450% growth in just four years.

With its skyrocketing value, a lot of investors had their eyes on gold by the end of the decade, and it would soon reach another high.

Why did the price of gold soar in the 1980s?

As the inflation crisis was in full swing in 1980, gold set a new record at $674.84. This was an increase of well above 1,600% over the span of one decade. When adjusted for inflation, this was also its highest price ever: $2,429.84.

Inflation, lack of economic growth, and soaring unemployment created the perfect storm of economic disaster, and many investors sought out gold as a hedge against stagflation, causing its price to skyrocket. History shows us that gold has performed well during times of severe crisis, which often cause its price to set new records.

And although past performance does not equal future results, several analysts predict the price of gold will rise to a new high, as mentioned above.