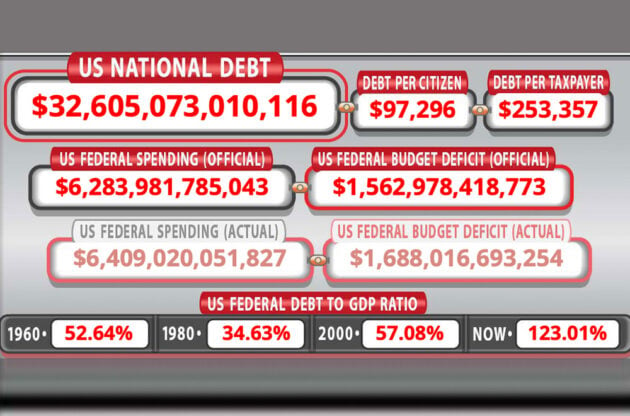

The US national debt is over $32 trillion, and it’s rising fast.

According to USDebtClock.org, every US taxpayer “owes” $253,000 and counting.

And by the time you finish this article, America’s debt bill may have grown by millions of dollars.

The US Central Budgeting Office (CBO) says “After all the government’s borrowing needs are accounted for, debt held by the public would rise from $24.3 trillion recorded at the end of 2022 to $46.7 trillion at the end of 2033.”

On Apr 25, 2023, Forbes said the national debt will rise to “nearly three times greater than current GDP [gross domestic product].” And “It’s clear that members of Congress are spending like drunken sailors and like the Titanic, the U.S. is on a collision course with a financial iceberg.”

It’s a debt that will weigh on both current and future generations

The Wall Street Journal published a scathing opinion calling it “a Rotten Legacy” for America’s children.

And the Peter G. Peterson Foundation, a bipartisan fiscal watchdog says, “the next generation will know debt like no other”.

Especially since the estimated debt figures shown above don’t include the billions of dollars in interest the federal government owes on its expanding debt obligation.

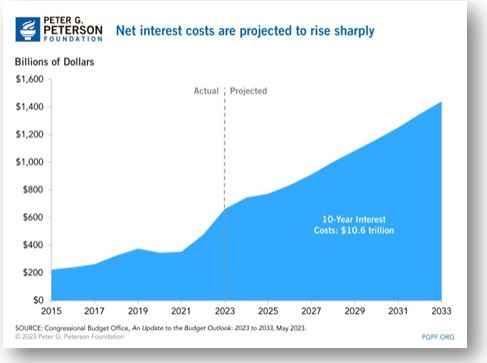

These interest payments are also growing fast.

The Peter G. Peterson Foundation reports, “the federal government spent about $1.3 billion per day on interest payments in 2022,” and “by 2033, the nation will spend about $3.9 billion per day.”

Will this borrowing and spending ever end?

Nobody knows for sure.

But the nation’s debt bill has grown during every White House administration since Herbert Hoover. And every time the federal government has reached its borrowing limit, Congress has agreed to suspend the limit “temporarily.”

As you may recall, Congress suspended their debt limit for the 91st time on June 2, 2023.

This latest temporary measure avoids default and gives the government another attempt to chip away at the debt. But it may only perpetuate a vicious cycle where the more money the government borrows to pay down interest, the harder it is to pay back the principal.

In two years, the debt-limit agreement will expire. And if Washington keeps spending at its current pace, it may once again risk defaulting on its debt. If it defaults for the first time in history, America could face unprecedented economic challenges ranging from higher borrowing costs to potential delayed or reduced payments on federal benefits such as Social Security to wider job loss and economic recession.

To avoid default, Congress and the White House may have no choice but to raise the ceiling a 92nd time. This means interest will continue to accrue. And, as Barron’s said on Feb. 17, 2023, “The U.S. Debt Will Keep Growing — and Growing”.

Like any borrower, the US is judged on its credit worthiness.

America’s debt has long been considered a safe asset as our government has always paid its financial obligations. As a result, those debts in the form of Treasury bills, bonds and notes have a zero-risk weighting for international banks.

The Associated Press says, “Foreign governments and private investors hold nearly $7.6 trillion of the debt — roughly 31% of the Treasurys in financial markets.”

And if global investors consider US debt to be a risk, which would be unprecedented, they could charge the federal government even higher borrowing rates. And it could affect the ability to pay federal benefits to US citizens.

As Forbes warned on April 25, 2023:

“If Congress doesn’t curtail its spending or the American people fail to take a stand against it, the national debt will soar until we hit the iceberg. However, at that point, it will be too late, and the federal government will be unable to meet its obligations or provide adequate support for many essential services, leaving tens of millions of Americans out in the cold.”

So, what can we do?

Diversification with physical gold may be key.

On June 15, 2023, Yahoo Finance reported JPMorgan Chase analysts agree and recently told clients it’s time to hold more gold. And according to Yahoo Finance, the bank is also putting its money where its mouth is by “shifting away from energy and moving full steam ahead towards gold.”

And the multinational bank isn’t alone in its opinion…

The World Gold Council says the world’s biggest central banks are acquiring more gold at the fastest pace on record. An official Gallup Poll recently revealed the number of Americans who consider gold a wise investment has doubled. And every day here at Gold Alliance, we’re hearing from folks who say they feel the same way.

Bottom line:

With history as our guide, it looks like the federal government may continue to borrow and spend indefinitely.

Debt and interest owed may continue to expand.

The burden on America’s current and future taxpayers may grow to excruciating levels.

And it may be time to note how the world’s smartest money is hedging against this growing uncertainty with gold… and adjust your financial self-defense strategy accordingly.

—————————————————————————————————-

If you’d like to know more about diversifying with gold as part of your financial self-defense strategy, request a FREE Gold Information Kit. Or call 888-529-0399 for a FREE, no-obligation consultation with a Gold Alliance Gold Specialist now.