The internet is awash with a murky mix of good advice, a few half-truths and a whole heap of nonsense about gold.

And for anyone considering gold for the first time, sorting fact from fiction can be a challenging task.

So today, let’s clear up 3 of the most common misconceptions about gold floating around and shine a light on the precious metal’s role in an uncertain economy.

Starting with…

Misconception #1: Gold isn’t a smart retirement asset because it doesn’t generate income.

Many Americans have a robust portfolio of traditional, dollar-based “paper investments” like savings accounts, 401(k)s, stocks, bonds and T-bills.

And the income-generating potential is attractive.

But what about protecting your earnings against potential losses?

We’ve all been taught the key is diversification.

The problem is…

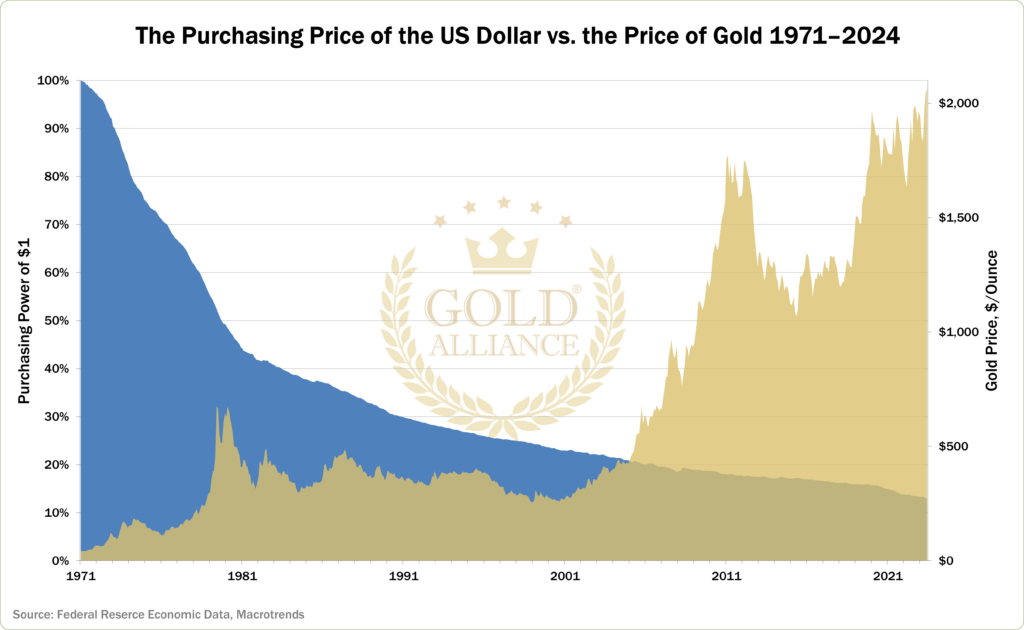

After decades of money printing and quantitative easing cycles, soaring inflation and interest rate rollercoasters, deficit spending splurges and an exploding debt crisis…

All those US dollars held in all those traditional investment vehicles are losing their purchasing power, and fast.

Unless those investments outpace inflation and the rate of dollar devaluation…

Diversifying a portfolio of dollar-based investments with more dollar-based investments may not offer enough downside protection to counteract future purchasing power losses.

Enter gold.

Thousands of Americans turn to gold in times of economic uncertainty because they know:

- Gold has intrinsic value. It can never fall to zero.

- Unlike dollar-based paper investments, gold has zero counterparty risk. It can’t default, go bankrupt or be printed, created or destroyed. And perhaps most importantly…

- Gold tends to GAIN price value as the dollar’s purchasing power dwindles as it has for over 50 years.

Since 1971, when Nixon decoupled the dollar from gold, the US dollar has lost over 85% of its buying power.

Meanwhile, gold’s price has risen an astonishing 4,670%:

And analysts say it looks like gold’s price may have plenty of room to run… with some price forecasts as high as $5,000 or even $10,000 an ounce in coming years.

Misconception #2: Owning gold ETFs is equivalent to owning physical gold.

In the last decade, many gold-backed exchange-traded funds (ETFs) have entered the market.

There are two main types: commodity ETFs and physical ETFs. Commodity ETFS are mutual funds designed to track gold’s price. Physical gold ETFs own and store gold in the fund’s vault.

Either way, you don’t own any of the gold with an ETF, nor can you receive physical gold. Instead, all ETF earnings are paid in dollars.

And for ETF proponents, that’s perfectly fine.

The challenge is…

Gold ETFs are subject to the same market volatility and counterparty risks as any other traditional paper investment.

Owning physical gold eliminates those counterparty risks because you are the sole owner and holder of the gold.

This is one of the reasons why many of the world’s biggest central banks—the Smartest Money—are still buying and hoarding massive amounts of gold as a strategic hedge against economic uncertainty.

Misconception #3: Buying, storing and selling gold is complicated and risky.

Every week, we help folks who are concerned about this. But when they finally decide to make their move, they’re often surprised to discover just how simple, fast and safe the process is.

It starts with a no-cost consultation with a gold specialist to clarify your needs, goals and options. Then, when you’re confident with your choices and ready to proceed, the purchase is straightforward, and delivery is easy.

You can buy gold bullion and take fully insured, direct delivery to your home or storage facility of your choice…

Or you can shift a portion of your 401(k), IRA, TSP or savings into a Gold IRA tax-free and penalty-free, and we’ll deliver it for you to an IRS-approved, high-security, low-cost vault for safekeeping under your name and control.

After that? Hold your gold until you’re ready to pass it to heirs or sell it.

Bottom line:

Gold’s stability as an asset is well-documented.

With its long record of resilience and price appreciation, gold remains an important asset to consider for those who want to mitigate traditional investment risks and feel more secure in uncertain economic times.

Or call 888-529-0399 to schedule a free consultation with an experienced Gold Specialist. There’s no obligation.