Billions of years before governments, banks, money, humans and the Earth existed…

Two neutron stars collided and scattered particles of gold into space. Scientists believe those gold particles fused into the Earth’s core as the planet formed. Then, ancient asteroid impacts broke the Earth’s crust and brought the precious metal to the surface for humans to eventually discover.

In other words, the gold you can hold in your hand today is quite literally stardust.

And since it was first discovered — perhaps glinting in an ancient riverbed — this mesmerizing metal from the heavens has fascinated humankind

Our ancestors recognized gold’s glimmering appeal and its practicality. And around 550 BCE, King Croesus of Lydia minted the world’s first gold coins.

Since then, competing forms of exchange of all shapes and sizes have come and gone — including livestock, salt, seashells, wheat, feathers, animal pelts and paper.

But none surpassed gold.

Here are 9 reasons why:

Reason 1: Gold is durable

Of the 118 elements on the periodic table, only a handful are practical candidates for money.

The noble gasses are stable, but you can’t make them into coins or carry them in your pocket. The alkali metals, like lithium, sodium and potassium, are highly reactive and unstable. As are 38 more elements. Some can even burst into flames when exposed to air.

The bottom two rows of the periodic chart contain radioactive elements. And of the 30 solid, nontoxic, non-reactive candidates remaining, only five are candidates for money:

Silver, platinum, palladium, rhodium and gold.

Of these five precious metals, platinum, palladium and rhodium are too rare and too difficult to coin on a large scale. Which leaves silver and gold. Both are rare enough — but not too rare — to find and mine. And both have cost-effective melting points to make physical coins.

As you may know, silver has been used for money many times throughout history. But it can tarnish and lose its luster. And silver is also far too soft to mint into coins designed to circulate for a long time.

This leaves gold.

Gold is virtually indestructible. It won’t tarnish, tear, decay, dissolve, burn, crumble or rust. And it essentially lasts forever without losing its shape or luster.

For this reason, nearly all the gold ejected from stars and mined from the earth still exists in some form — including King Croesus’ still-shiny coins from Lydia.

Reason 2: Gold maintains its value when divided

Rip paper currency in half, and the torn pieces become worthless

Gold, on the other hand, loses no value when divided.

If gold is priced at $2,000 an ounce, for example, divide that ounce in half and you now have two half ounces worth $1,000 each. Cut them in half again and each quarter ounce is worth $500.

Reason 3: Gold is uniform and unchanging

An ounce of pure gold in your hand today is identical to an ounce of pure gold mined in ancient Lydia or an ounce of gold dust blown from an exploding star before the dawn of history.

This unchanging nature makes gold ideal as a standardized, uniform unit of exchange regardless of place and time.

Reason 4: Gold’s value-to-size ratio makes it easy to transport and store a lot of wealth in a small space

$10,000 in gold at current prices, for example, weighs a mere five ounces. $100,000 in gold bullion weighs about 3.2 pounds.

And some gold bullion is so rare a single coin could be worth many hundreds of thousands or even millions of US dollars.

The 1933 Double Eagle, for example, is so rare that experts estimate only 15 coins remain. One of the 15 sold for a whopping $7.59 million at a 2002 auction. And if you owned all 15 coins, the multi-million-dollar fortune would fit in the palm of your hand.

Reason 5: Gold is easy to buy and sell

You can buy or sell physical gold in any form in any developed country with ease.

It’s simple to convert gold to any currency by selling it on the open market. And in most cases, the transaction only takes a few minutes.

Reason 6: The world’s gold supply is finite

While the total amount of physical gold available in the world is unknown, the supply is fixed.

In fact, the US Geological Survey estimates “About 244,000 metric tons of gold has been discovered to date,” and it “would fit into a cube that is 23 meters [75.46 feet] wide on every side.”

This gives gold value through simple supply and demand.

Reason 7: Governments can’t print gold

Throughout the 19th and early 20th centuries, US currency was issued as gold certificates.

Each bill’s face value was worth a fixed amount of gold. And you could redeem the bill at any US bank to receive your gold on demand.

But that ended in 1971 when President Nixon severed the US dollar’s link to gold. Dollars were then issued by decree (also called “fiat”) — backed not by a durable, indestructible metal but by the full faith and credit of the United States government.

This new fiat currency system gave central banks the power to create new dollars at any time for any reason.

And this, critics argue, is the dollar’s weakness.

Because the more the US Treasury expands the money supply, in simplest terms, inflation rises because of the less purchasing power dollars have through simple dilution.

Meanwhile, gold is a physical commodity, and its supply is difficult to expand. This has made gold historically a trusted hedge against inflation over the long term.

And if the federal government continues to print money… and if gold behaves as it generally has… we could see it not only hold its value but also grow in value over time because…

Reason 8: Gold is a reliable store of value

To maintain its financial utility in society, the value of any money must remain relatively stable over long periods.

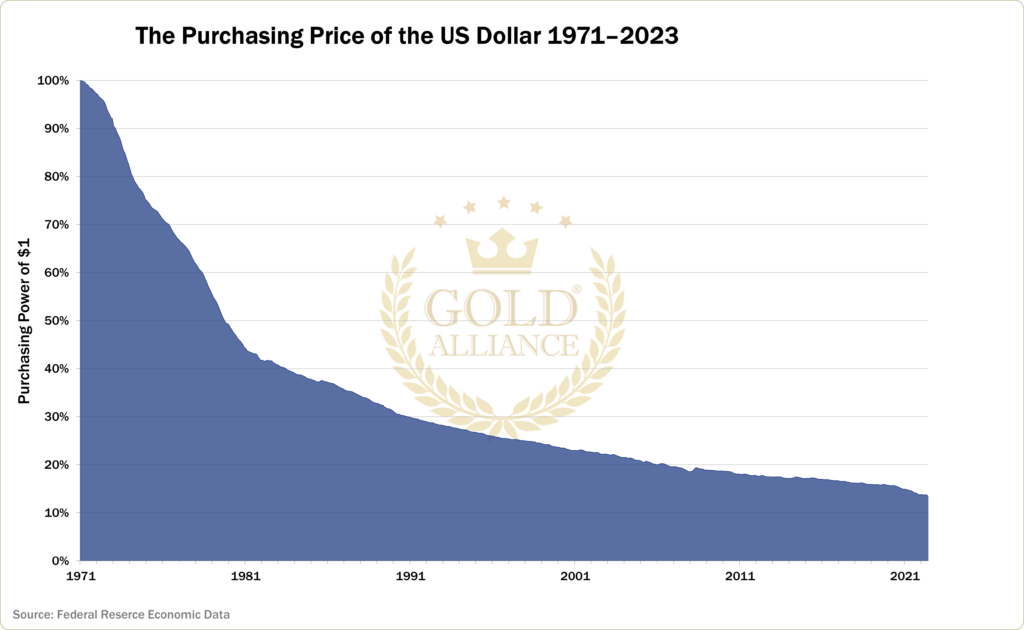

Since the “Nixon Shock” of 1971, the Fed reports the US dollar has lost an estimated 87% of its purchasing power.

But in those same 52 years, gold has gained nearly 5,000% in value relative to the falling US dollar.

In other words, gold hasn’t been devalued by overprinting.

But that’s not all.

Gold has not only outperformed the US dollar over time…

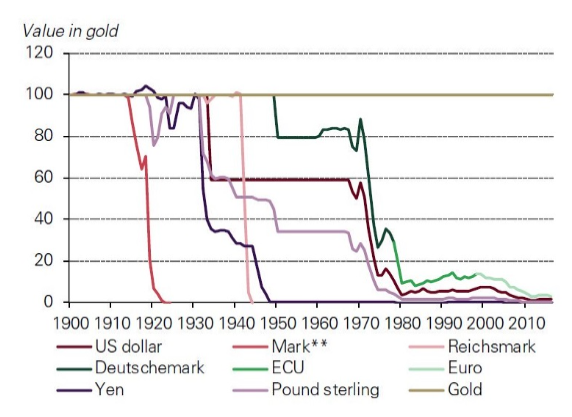

Reason 9: Gold has outperformed ALL major fiat currencies since 1900

As you can see in the chart above, despite consistent loss of value across the board for fiat currencies, gold has maintained its value.

And this is one of the reasons central banks across the world not only own gold but also buy it in mass quantities at an accelerated rate.

The question is:

Will America return to the Gold Standard?

Some experts argue against the idea. David Wheelock, vice president and deputy director at the St. Louis Fed, says tying the US dollar to gold doesn’t guarantee financial or economic stability.

“The U.S. mines a lot of gold, but we’re not the biggest producer,” Wheelock says. “The bigger suppliers of gold would have more control over our monetary policy, and there’s no reason to have it because we can get the advantages of the gold standard and avoid the disadvantages without being on a gold standard.”

Other financial experts, including Steve Forbes, advocate a return to the Gold Standard.

According to Forbes, “… the existence of a gold standard would have prevented the economic disasters of this century, including our present woes. For starters. you don’t get inflation with a gold-based monetary system.”

Bettina Bien Greaves of the Foundation for Economic Education agreed and wrote, “under a gold standard … the purchasing power per unit of gold would be more stable than under an unpredictable paper currency standard.”

And economist Ludwig von Mises wrote, “The gold standard has one tremendous virtue: the quantity of the money supply, under the gold standard, is independent of the policies of governments and political parties. This is its advantage. It is a form of protection against spendthrift governments.”

Forbes, Greaves and von Mises understand what King Croesus of Lydia and countless others have known for thousands of years:

Gold — the precious metal from the stars — is the superior form of money.

————————–

Find out more about how gold can help protect your purchasing power, and why so many experts and analysts believe the price of gold may soon soar to record highs, get a FREE copy of the 2023 Gold Information Kit here. Or call 888-529-0399 to speak with a Gold Alliance Gold Specialist. There’s no cost or obligation.

(Featured image via Ismoon (talk) 10:44, 11 February 2022 (UTC), CC BY-SA 4.0, via Wikimedia Commons)